Mega Backdoor 401k Limit 2025

Mega Backdoor 401k Limit 2025. All 401 (k) and 403 (b) plans allow employees to make pretax elective deferrals up to annual limits ($22,500 for 2025, or $30,000 for those age 50 and older),. A worker who pays a 22% tax rate and can contribute $33,000 to a traditional 401 (k) and.

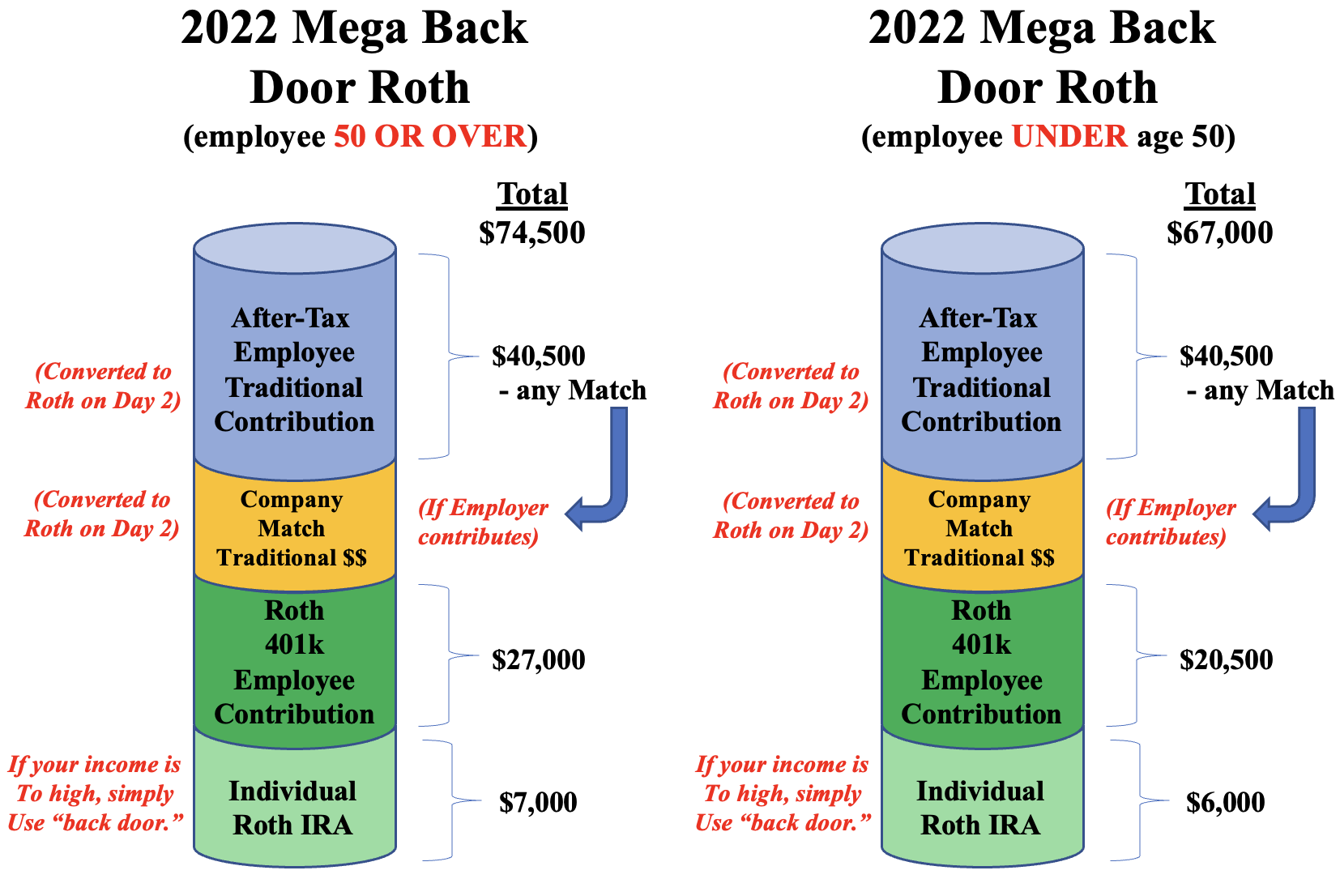

In 2025, the solo 401k contribution limit is $69,000 ($76,500 if you’re 50 years of age or older). In 2025, the total dollars allowable into a 401 (k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older.

The mega backdoor roth allows individuals to roll over substantial amounts—up to $43,500 in 2025—from a traditional 401 (k) to a roth ira or roth 401.

If your 401 (k) plan permits it, in 2025 the ira lets you and your employer contribute up to $69,000 —$46,000 above that year’s elective deferral limit—every year.

The Magic of the Mega Backdoor Roth Mark J. Kohler, How much can you convert with a mega backdoor conversion in 2025? Therefore, a backdoor roth ira offers a workaround:

:max_bytes(150000):strip_icc()/Mega-backdoor-roth-401-k-conversion-5210877_final-3e68d3495c174dc5a6d5f7fedd49d4cf.png)

The Mega Backdoor Roth How Does It Work? RGWM Insights, Therefore, a backdoor roth ira offers a workaround: Save additional money each year on an.

How a Mega Backdoor Roth 401(k) Conversion Works, You can fully leverage these limits by taking. With a 401 (k), the employee can add up to $23,000 (under age 50) and $30,500 (over age 50) into their 401 (k) account either on a traditional or roth basis for.

When Will Irs Announce 401k Limits For 2025 Cindy Deloria, The annual contribution limit is $7,000 for 2025, plus an extra $1,000 if you’re age 50 or older. How does this add up?

Amazon Mega Backdoor Roth Sophos Wealth Management, The maximum employer + employee 401k plan. This is the total irs limit minus the 401(k) contribution limit.

2025 META 401(k) & Mega Backdoor Roth Save Thousands Towards, The maximum employer + employee 401k plan. How does this add up?

Mega Backdoor Roth 401k Retirement Savings Strategies for High, The mega backdoor roth allows individuals to roll over substantial amounts—up to $43,500 in 2025—from a traditional 401 (k) to a roth ira or roth 401. For those who are married filing jointly, the income limit is $240,000 in 2025, up from $218,000 in 2025.

How to upgrade Fidelity Solo 401k to Mega Backdoor Roth Solo 401k? My, The annual contribution limit is $7,000 for 2025, plus an extra $1,000 if you’re age 50 or older. The backdoor roth ira sounds great, but what is it exactly?

How Mega Backdoor Roth Contributions Can Boost Your Retirement Savings, Therefore, a backdoor roth ira offers a workaround: In 2025 and 2025, you could contribute up to $6,000 ($7,000 if 50 or over) per year.

Mega Backdoor Roth Solo 401k FAQ When is the 1099 R issued for Mega, Often when an employer introduces the mega backdoor roth concept, only hces participate. In 2025, the total dollars allowable into a 401 (k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older.