Eitc Tables 2025

Eitc Tables 2025. Federal income tax tables in 2025. 51 was discontinued after 2025.

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Page last reviewed or updated: Federal married (separate) filer tax tables.

Eitc Calendar 2025 December 2025 Calendar, Federal income tax tables in 2025. Department of the treasury internal revenue service.

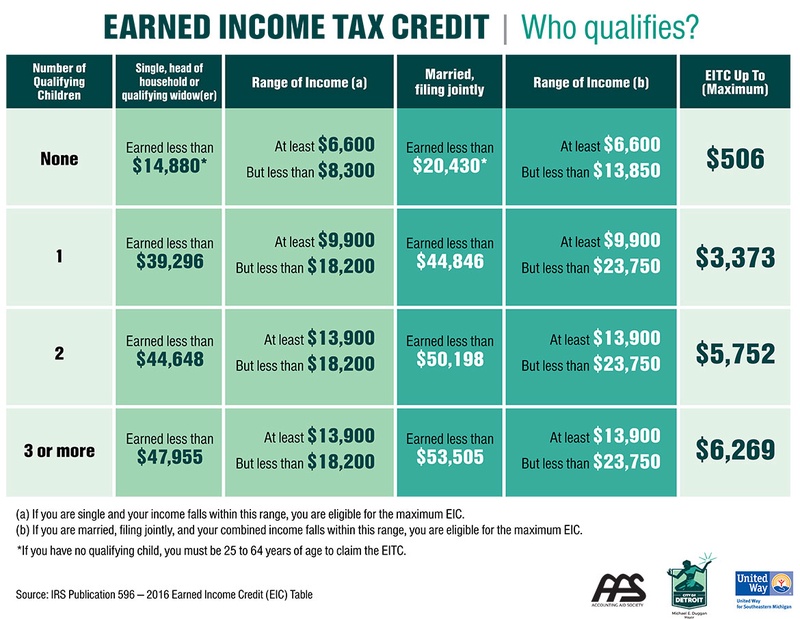

EITC Parameters Tax Policy Center, Federal income tax tables in 2025. To claim the earned income tax credit (eitc), you must have what.

Easiest EITC Tax Credit Table 2025 & 2025 Internal Revenue Code, 51 was discontinued after 2025. Federal single filer tax tables.

Publication 596, Earned Credit (EIC); Appendix, Clean energy and vehicle credits; 2025 tax season irs tax credit changes:

The Earned Tax Credit (EITC) A Primer Tax Foundation, Rule 2—you must have a. Department of the treasury internal revenue service.

Federal Withholding Tables 2025 Federal Tax, Earned income credit (eitc) child tax credit; Federal income tax tables in 2025.

T220250 Tax Benefit of the Earned Tax Credit (EITC), Baseline, The average income tax rate in 2025 was 14.9 percent. Download or view irs publications specific to refundable credits, eitc, actc and aotc.

2025 Tax Bracket Changes and IRS Annual Inflation Adjustments, However, the irs estimates that about 15% of eligible individuals do not claim this tax credit. Rule 2—you must have a.

Earned Tax Credit for Households with One Child, 2025 Center, See the earned income and adjusted gross income (agi) limits, maximum credit for the. As you navigate through the tax.