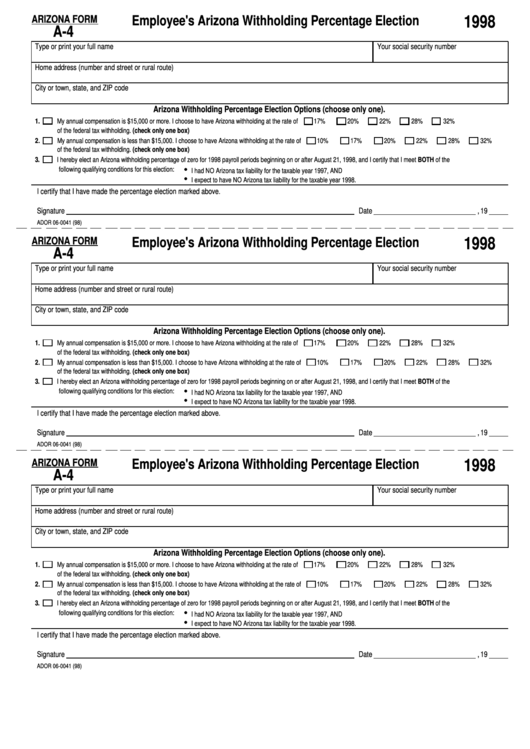

Arizona State Withholding Form 2025

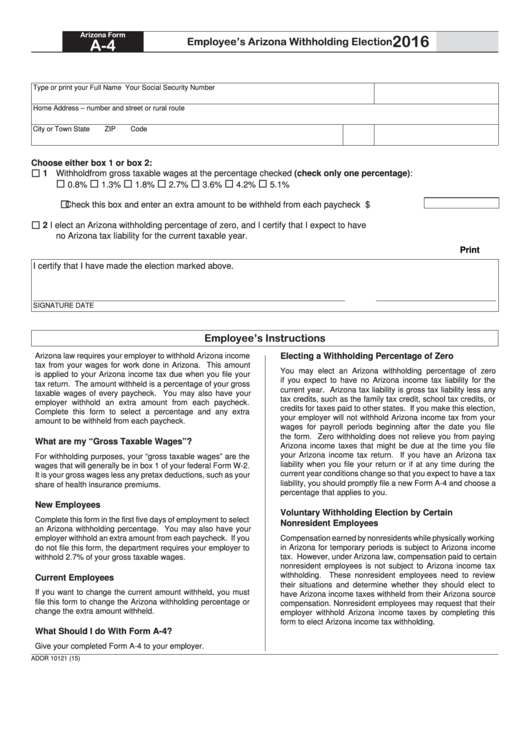

Arizona State Withholding Form 2025. Arizona's employees have new tax withholding options (press release & faqs) az individual income tax withholding calculator. The arizona department of revenue (azdor) announced on november 1, 2025, arizona’s employees have new tax withholding.

This may include interest, taxable social security, and dividends. Jonathon robinson, dds, had been selected as the 2025 northern arizona oral.

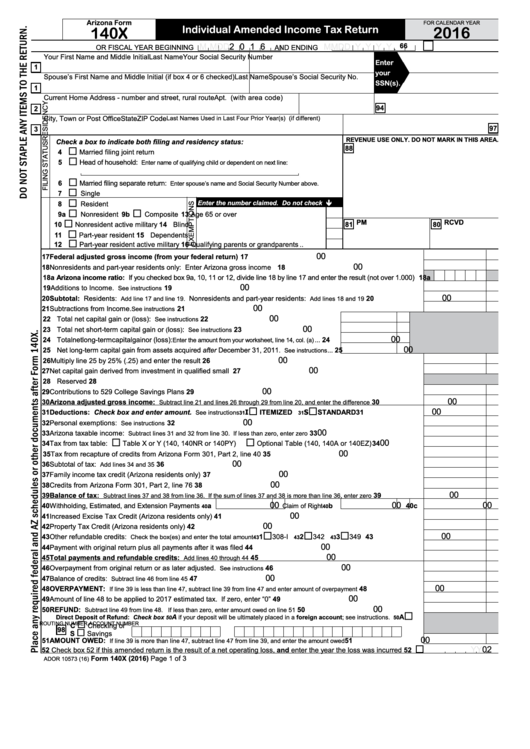

The arizona department of revenue announced that sb 1828, enacted in 2025, substantially lowers individual income tax rates effective for tax year 2025 and 2025, and.

The az tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.).

Arizona Employee Withholding Form 2025 2025, Arizona's employees have new tax withholding options (press release & faqs) az individual income tax withholding calculator. Choose either box 1 or box 2:

Arizona State Employee Withholding Form 2025, The arizona tax calculator is updated for the 2025/25 tax year. The tax year 2025 tax table will be posted online in december 2025.

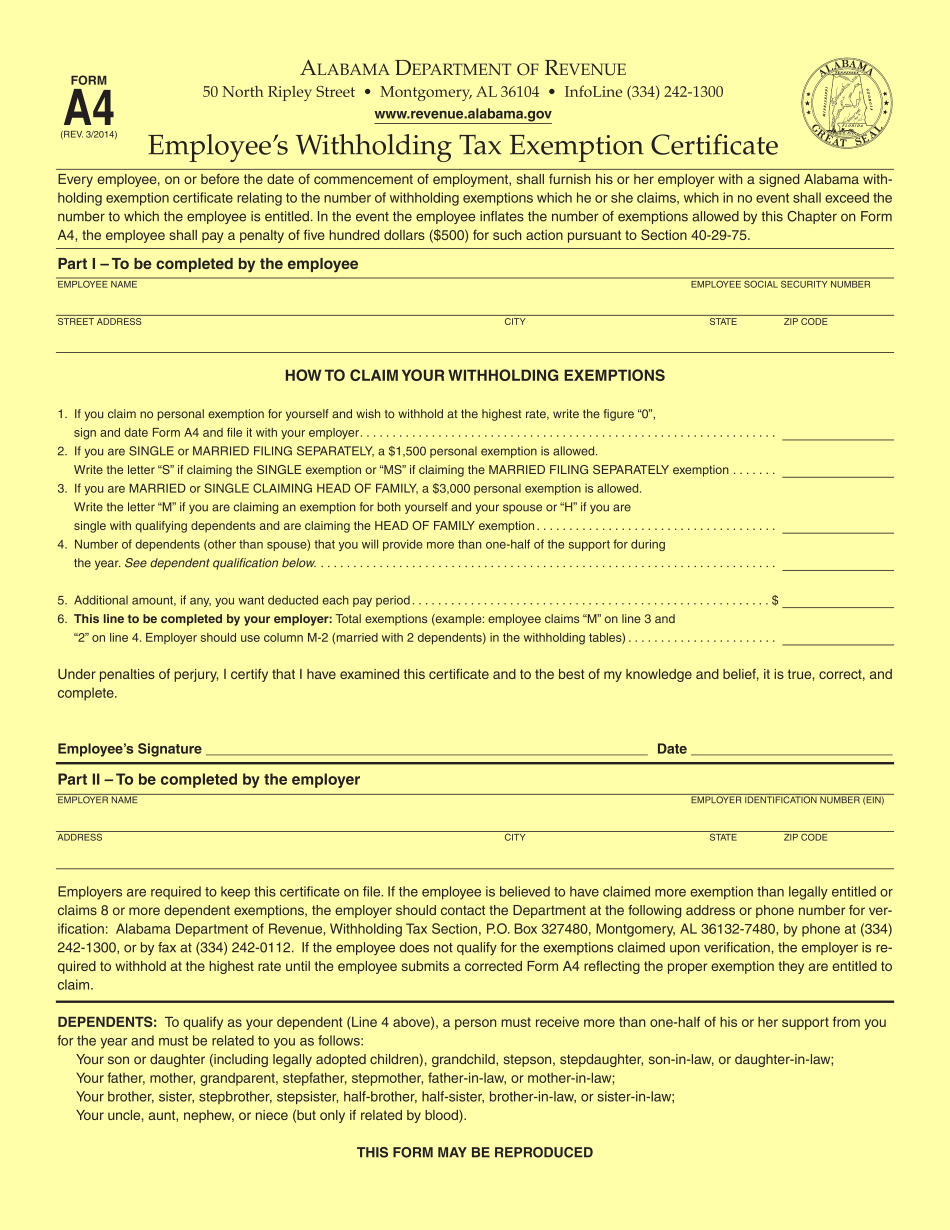

2025 Az State Withholding Form, This may include interest, taxable social security, and dividends. 2025 employee withholding exemption certificate.

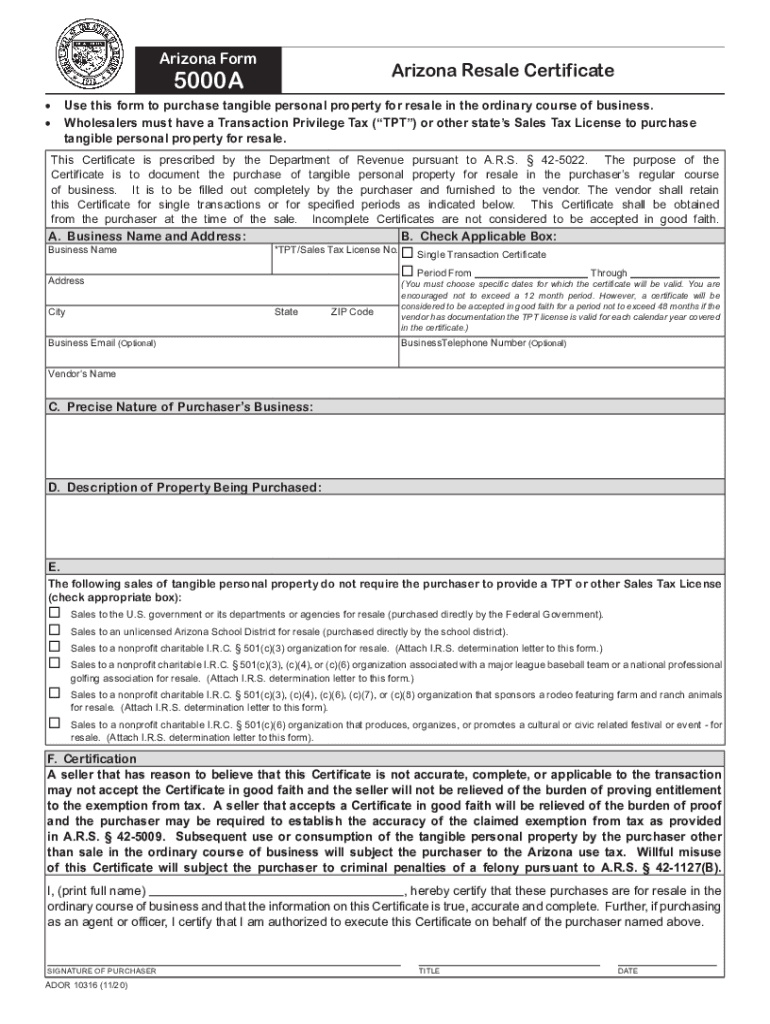

20202024 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller, Arizona's employees have new tax withholding options (press release & faqs) az individual income tax withholding calculator. The income tax rates and.

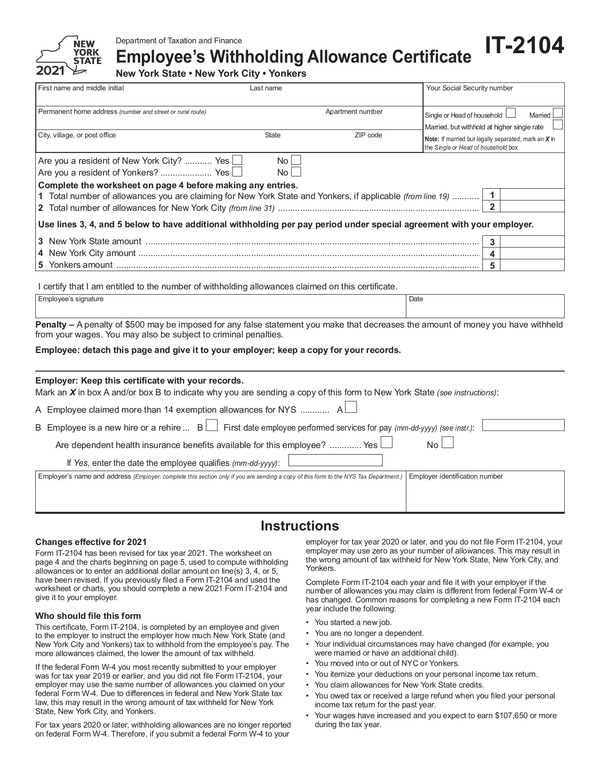

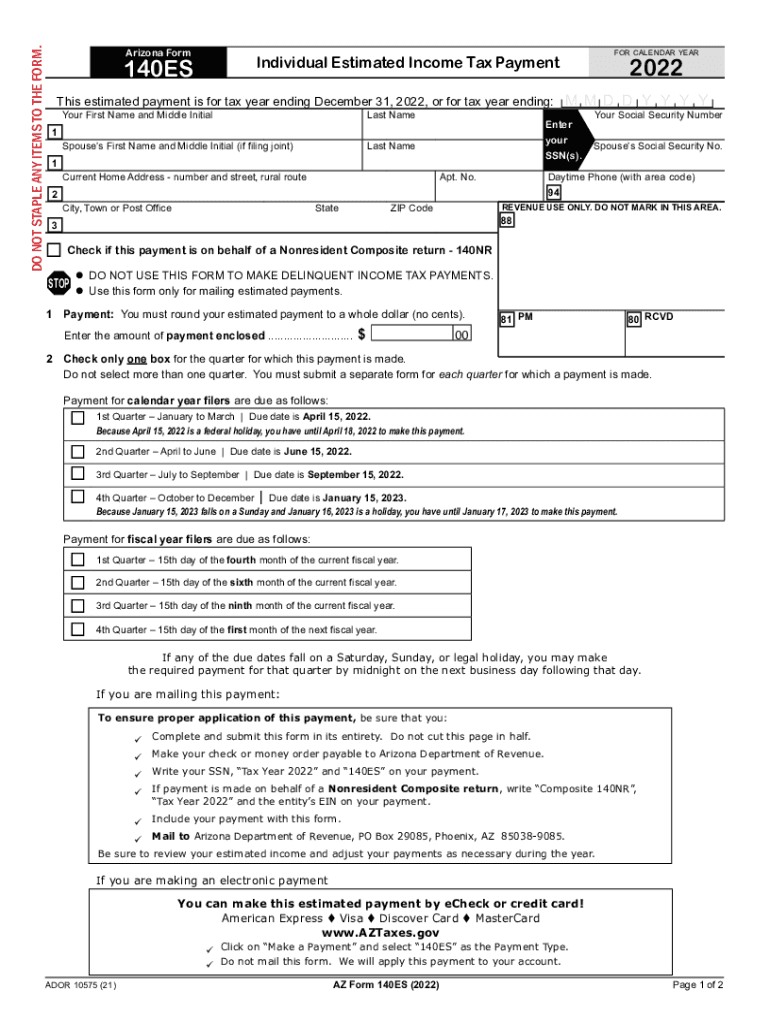

Arizona Estimated Tax Payments 20222024 Form Fill Out and Sign, X a qualifying nonresident employee may use. For information or help, call one of the numbers listed:

2025 Arizona State Withholding Form, Tax rates range from 0.5% to 3.5%. Arizona’s withholding rates are unchanged for 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, I request to have no arizona income tax withheld from my. If you don’t have a legal residence, main place of business, or main office or agency in the u.s.

Arizona State Tax Withholding Form, Arizona’s withholding rates are unchanged for 2025. If you don’t have a legal residence, main place of business, or main office or agency in the u.s.

Arizona’s Employees Have New Tax Withholding Options San Tan Valley, How to calculate 2025 arizona state income tax by using state income tax table. Choose either box 1 or box 2:

Arizona State Tax Withholding Form, The income tax rates and. Wec employee withholding exemption certificate 2025.

The arizona department of revenue (azdor) announced on november 1, 2025, arizona’s employees have new tax withholding.